How To Leverage Market Volumes For Investment Strategies

How to use market volumes for investment strategies in cryptocurrenia

The cryptocurrency has seen rapid growth in the last decade, and many investors have plunged into this class of digital assets. . . However, the belt lever is not without its risks and it is necessary to understand how to do it right.

** What is lever trafficking in cryptocurrenia?

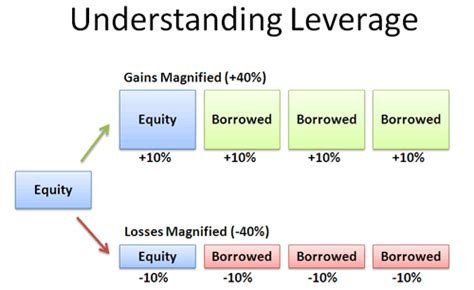

The tradition of leverage involves the use of borrowed money or credit to increase the possible return on investment. In crypto -trading, the lever effect factor is calculated as the ratio of the amount you want to invest (the “amount of lever effect”) to the amount you need to borrow from the intermediary (“borrowed amount”).

$ 1,000 for borrowed funds, your lever effect would be 10: 1. This means that you can potentially trade up to $ 10 for all dollars invested.

Advantages of lever trafficking in cryptocurrency

The tradition of league effect offers several benefits, including:

* increased potential returns : to

* reduced risk :

.

How to use market volumes in cryptocurrenia

Follow the following steps to use the market volume:

1.

- ** Select the right amount of lever effect

*

- Set the position of position : Calculate how much you want to invest in each store

Risks of lever trafficking in cryptocurrency

Although the lever effect can be beneficial, it also represents significant risks, increased:

* Increased cost of lever effect : Higher lever effect means higher fees and commissions.

* market volatility

: The cryptom market is subject to extreme prices that may result from unforeseen events or changes in the market sentiment.

* risk of liquidity :

Proven procedures for lever trafficking

Pottuns, follow these proven procedures:

- Start with a low lever effect Amoust :

2.

.

- Educate : Stay in the current state of market development, regulations and business strategies to ensure that you are well informed and ready for potential challenges.